Investment refers to the purchase of capital goods like machinery or a new computer aided design system.

These goods will be used repeatedly over a period of time.

This investment is likely to generate a return in the future.

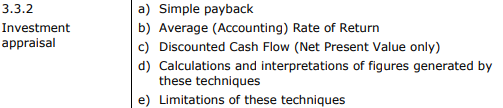

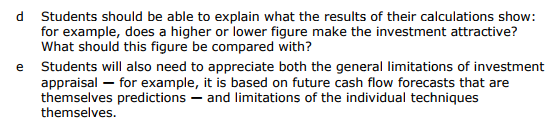

Investment appraisal describes how a business might objectively evaluate an investment project to determine whether or not it is likely to be profitable.

Investment appraisal allows for a comparison between competing investment options.

Capital cost: the amount of money spent when setting up a new venture.

Net cash flow: cash inflows minus cash outflows.

Payback:

The amount of time it takes for a project to recover or pay back the initial cost.

More details here.

Average (Accounting) Rate of Return (ARR):

This gives a % rate of return.

Formula:

Net return (profit) per annum x 100

Capital outlay (cost)

More details here.

Discounted cash flow (net present value or NPV):

This takes into account what cash flow or profit earned in the future is worth at the present value.

Money in the future is worth less than the same amount now (the present value).

Discount tables can be used to show by how much a future value must be multiplied to calculate its present value.

Cash flow or profit of £15,000 received in five years time, at a discount rate of 5% would be worth

£11, 753.

How to calculate NPV and advantages / disadvantages - details here.

Discounted cash flow (net present value or NPV):

This takes into account what cash flow or profit earned in the future is worth at the present value.

Money in the future is worth less than the same amount now (the present value).

Discount tables can be used to show by how much a future value must be multiplied to calculate its present value.

Cash flow or profit of £15,000 received in five years time, at a discount rate of 5% would be worth

£11, 753.

How to calculate NPV and advantages / disadvantages - details here.

Remember......

When making any investment appraisal decision qualitative factors should always be considered alongside quantitative factors.

What will be the impact on staff?

Will the quality of the product change?