Mergers and takeovers occur when firms join together and operate as one organisation.

Mergers are usually conducted with the agreement of both businesses. Usually friendly.

A takeover, sometimes called an acquisition, occurs when one business buys another. Often hostile.

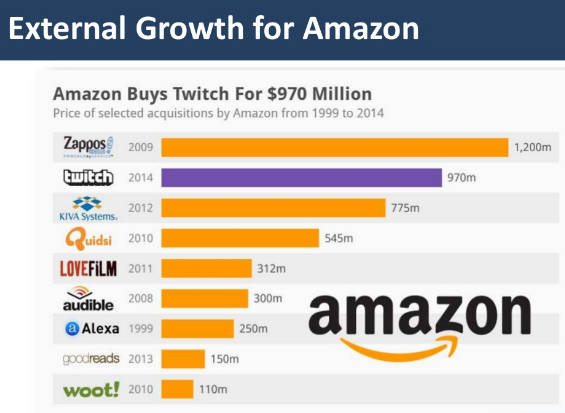

Sometimes called 'external growth'.

Why?

1. Synergies: "the whole is greater than the sum of the parts"

Cost synergies:

Perceived benefits from cost savings.

Revenue synergies:

Increased market share and a larger customer base.

2. Economies of scale from larger scale operations.

3. "Asset stripping"

4. The reduction in risk through diversification - Coca Cola takes over Innocent.

Click on the picture.

5. Eliminating competition.

6. A fast way to expand the business.

In 2015 O2 was taken over by Three.

It was reported that the cost of the takeover would be £10,500,000.000.

September 2017.

Google buys part of HTC mobile R&D division for a billion dollars.

Horizontal and vertical integration:

Horizontal integration.

When two firms in exactly the same type of business and at the same stage of production join together.

- Dec 2015: Domino's buys largest German pizza chain in $86m deal.

- 2015: Horizontal mergers in the betting industry: Ladbrokes and Gala Coral, Betfair and Paddy Power.

Benefits of horizontal integration:

Eliminate competition

Increased revenue

Opportunities for rationalisation

Vertical integration.

Occurs when firms in different stages of production join together,

1. Forward vertical integration occurs when a business joins with another that is in the next stage of production or distribution.

- Sept 2015: (Wholesaler) Booker given green light for takeover deal worth £40m of Budgens and Londis grocery chains.

Why?

This would increase distribution of Booker products in these stores.

Also, this would give Booker the profit margin previously enjoyed by the store chains.

2. Backward vertical integration occurs when a business joins with another in the previous stage of production.

Nov 2015: Ikea Buys Romanian, Baltic Forests to control its raw materials.

Why?

Guarantees supply and quality of timber.

Removing the profit margin from the previous owners.

Financial risks and rewards of mergers:

1. Regulatory intervention.

Mergers and takeovers in the UK may attract the attention of the Competition and Markets Authority (CMA).

Click on the picture:

Financial risks and rewards of mergers:

1. Regulatory intervention.

Mergers and takeovers in the UK may attract the attention of the Competition and Markets Authority (CMA).

Click on the picture:

If they think a merger or takeover is against the public interest they can order an investigation.

This takes time and will cause delays.

Mergers can be blocked or allowed to proceed with conditions attached.

2. Resistance from employees.

3. Integration costs.

4. A clash of cultures.

http://www.globoforce.com/gfblog/2012/6-big-mergers-that-were-killed-by-culture/